Investment Committee – November 2021

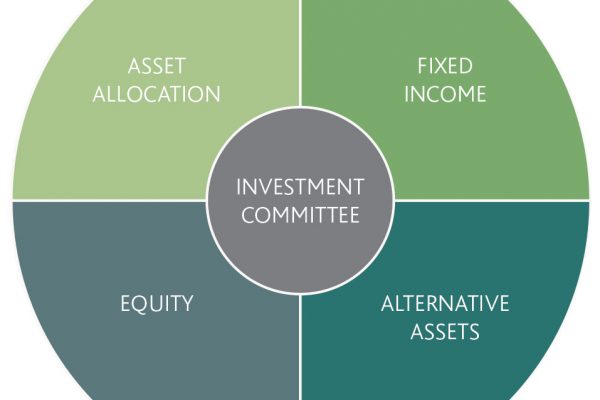

The firm’s Investment Committee discussed how financial markets might face a multi-leg squeeze going into year-end. It stressed the rising energy prices, the infamous supply-chain bottleneck, and the much anticipated Fed tapering of its asset purchases schedule (which, actually, has in the meantime been announced by the Fed during its latest press conference). The better news is that we believe we will probably be back into a reflationary environment in 2022.

Read More →Investment Committee – October 2021

The Investment Committee’s latest meeting discussed market activity for September, and conferred on the best route to navigate markets towards year-end. These are the main points that were brought up: […]

Read More →Positioning for inflation ahead

KM Cube’s Investment Committee discusses strategies to position for an inflationary environment, using niche tools available in our product line. These summarized notes highlight our perspective for what is considered […]

Read More →Rethinking The Role Of Bonds

Bonds might be heading for a period of under performance

Income from bonds appears to be dead. Rates are drifting lower for approximately 20yrs. We find that the fixed-income allocation of client portfolios has been targeting longer maturities in order to compensate for the loss of revenue.

Investment Committee – September 2021

With stock markets at all-time-highs, and interest rates orbiting all-time-lows, we take again one step back to look at the wider picture – and make sure we have a clear view of what’s driving prices.

Read More →Selection of Value Stocks September 2021

Our approach One of the most effective ways to identify such stocks is the Piotroski f-score. This metric along with some additional value criteria shown below allows us to limit the […]

Read More →