Gold miners vs Gold: A word of caution

Investors often buy gold mining stocks as an indirect play to gain exposure to gold. While there is nothing wrong with such investment one should be cautious on the differences, as the devil lies in the details…

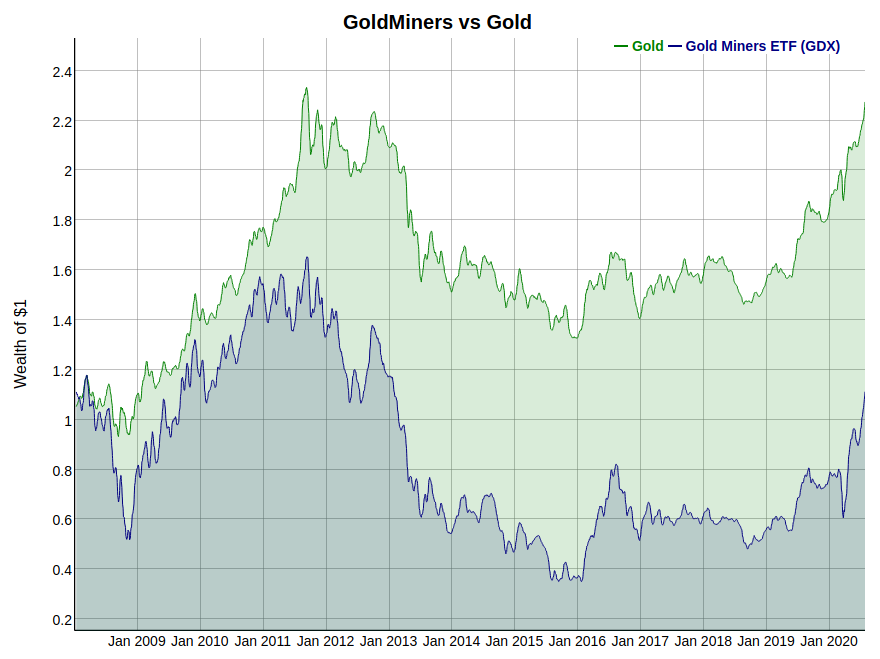

The graph below shows the performance of Goldminer ETF (GDX) vs Gold. One can easily spot that performance is far from similar.

In a nutshell, performance of gold miner stocks is depended on:

- The price of gold in relation to company’s inventories

- Profitability of the company

- Quality of management

- Success (or not) in hedging gold exposure

- Dividends

Correlations

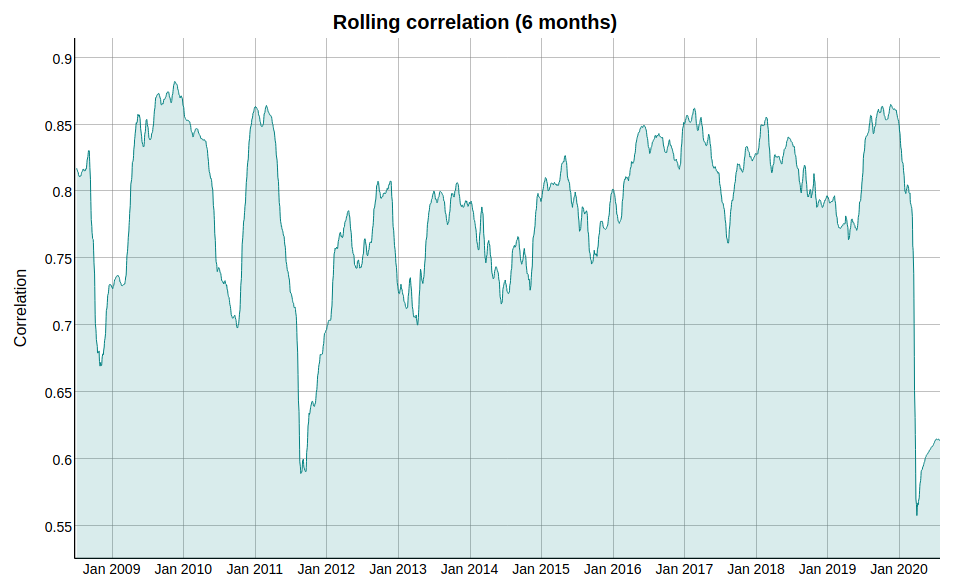

As gold miner companies depend on the prevailing market price for the goods that they sell, these stocks generally exhibit strong correlations to movements in spot gold prices. It should be noted, however, that this relationship is not perfect; in certain environments, gold miner stocks and physical gold prices can move in opposite directions, and correlation between the two can be less than perfect.

A leveraged play

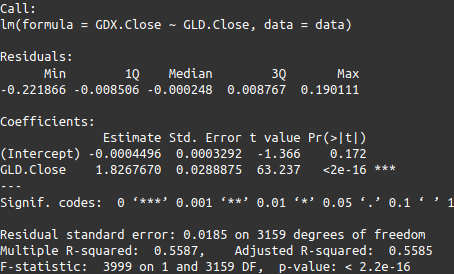

When gold prices go up, gold miners make more money (and vice versa). As such, performance of gold mining stocks tend to exhibit leverage in relation to gold but this seems to be so for short periods of time. As can be seen below from a simple OLS regression, returns on Gold miners are 1.8 times leveraged with respect to gold.

Benefits

There are a number of potential benefits to investing in gold through stocks. Some investors have a hard time with the fact that physical gold will never make a distribution or generate a cash flow. Gold miner stocks make dividends and report earnings, which can make valuation more straightforward.