Retail options activity: To worry or not?

Derivatives trading volume in the US has exploded over the past year and this upswing is more evident in small trades of 10 contracts or less. These are typically the kind of trades dominated by retail investors rather than big players. The amount spent on options premia has declined during autumn but is now back to record highs.

The European market

On the contrary, options volume in Europe is stable at best and in many countries declining since 2014. One may think that lack of interest, or lower liquidity, is keeping investors away from regional indices or exchanges with companies whose market cap is merely a 50% of their relevant US peers. But a closer look at what’s happening in the European derivatives market offers a more factual picture of what’s been going on under the hood.

Yes, retail investors in Europe are shy of the options market. This is because ‘derivatives’ is a word with negative connotation for the average European. The mainstream opinion is that if you regularly invest in derivatives, sooner or later you get burned. So Europeans look to other segments of the market to gain some appealing returns. Predominantly, they do that through customized structured products.

Structured notes are very active in Europe

The structured products culture is gargantuan for Europe. Investors go out and buy a note whose main attractive feature is some nominally high coupon, and these notes usually deliver the worst-of from a basket of stocks. That basket’s main constituents almost always include the EuroStoxx or a member of the EuroStoxx. Now, these notes are based on the index future nominal price; not the index cumulative return. Hence a European structured product never includes future dividend payments in their pricing. When the issuer of the note goes out to buy the underlying index to hedge the performance they promised the investor, they are left with forward dividend payment risk. In plain language, this means they have to go out and sell dividend futures at any price.

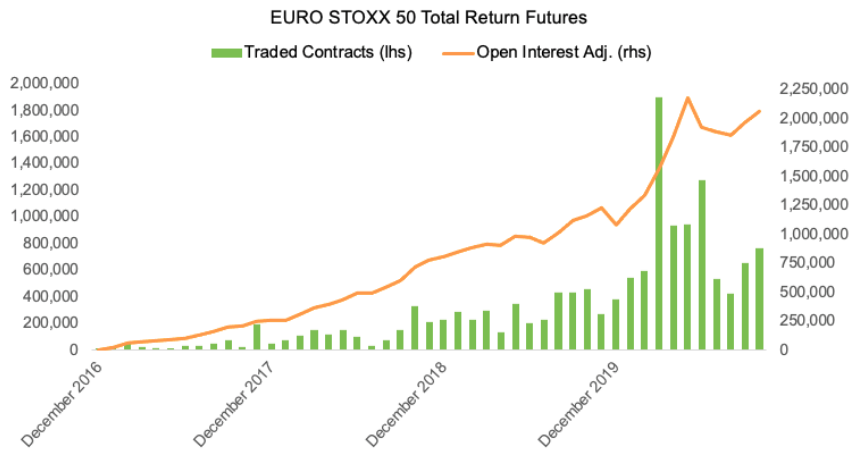

This translates to EuroStoxx Dividend futures and EuroStoxx Total Return futures being the market of last resort for hedging derivatives exposure generated from retail investors. Their volume is also recently spiking to all-time-highs:

Hence, contrary to common belief, it appears the European investor is also very active in derivatives. And more so, in a proportion similar to his US counterpart.

The magnitude of options trading in the US has reached its highest breadth just at the time the volume of dividend and total-return futures is peaking in Europe.

Usually, such an extent of retail market participation is a late-cycle phenomenon and may signal a mature market pattern. We are not advocates of a market reversal happening imminently, but we register that thought in the big scheme of things. We believe so should you.