Crypto Cash & Carry Trade

In markets and in life there is no such thing as a free lunch. Thus it is with extreme interest that we follow a rare arbitrage that has recently popped-up in the cryptocurrency domain. The arbitrage is factual, it is persistent, and it offers a quite compelling opportunity to those who commit time and devote the necessary effort to set up all legs of the trade.This is a snapshot what is going on under the hood:

- The arbitrage is actually a so-called ‘basis trade’, capitalizing on the future price of the underlying instrument relative to its price today.

- Its most conservative implementation locks-in profits to the range of >12% p.a.

- The opportunity arises because of regulated exchanges’ unattractive leverage and collateral requirements (for example, in Chicago’s CME one future contract = 5 Bitcoins = $210,000 margin if long, or $510,000 margin if short. This kind of binded collateral makes it prohibitive to a retail investor. Furthermore, US exchanges do not accept cryptocurrencies as collateral).

- On the other hand, offshore exchanges offer higher leverage and access to smaller amounts, hence they captivate all interest in tiny investments that appear appealing only if notional is to return something stellar (i.e. you invest EUR100 only if you aim to make astronomical returns. A return of 80% or 100% does not make a difference in your life). Thus, retail interest drives offshore cryptocurrency futures trading higher than the underlying currency, and this offers an attractive premium to harvest.

- Steps: Buy crypto -> move wallet to futures platform -> move wallet to collateral -> short underlying future.

- Risks: a) Potential inability to withdraw all your profits at once (i.e. you might make $20k or $50k and need 15 days to withdraw the money).

b) Credibility of platform (crypto platforms are not regulated and you’ll need to go with a platform that will not blow up if cryptocurrencies crash)

c) Explosion of spread (i.e. from 4% to go to 20%, hence requiring more collateral). - Risks (b) and (c) may be substantially mitigated if investors stick to well-know cryptos (think Bitcoin and Ethereum only) and they post almost full collateral, i.e. 97%-98%.

- The idea is to go for BTC and ETH only, front months’ futures (June, September), through the top known crypto platforms (i.e. Binance) posting all your cryptos as collateral so that you are never caught in need.

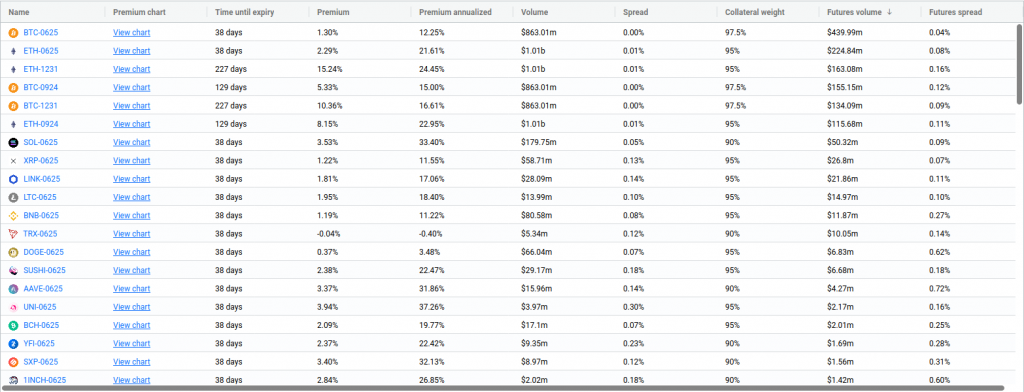

- The table below shows how June Bitcoin (trades at 1.30% profit for a 38 day investment (annualised 12.25%), while September Ethereum trades at +8.15% profit (in 129 days). Bitcoin December (227 days) offers return +10.36%. These numbers are updated live at ftxpremiums.com

- The profit is harvested when at expiration of the future contract you are short your account automatically delivers the cryptocurrencies you have bought long at initiation of the trade (and are kept as collateral with the same exchange), hence you are left with no investment position in your portfolio, but with cash US dollars from the difference of the two prices you have locked-in!

- History proves that such conditions never carry on perpetually, hence we can see how these spreads may be shrinking going forward, but in the meantime we see this as a rare opportunity for attractive returns, and a major trade that will surely leave its footprint in the cryptocurrency universe.

Disclaimer

Please note that this communication and the views expressed therein are of the individual only and do not reflect any opinions expressed by KM Cube Asset Management. KM Cube Asset Management does not offer any investment services, of any kind, in relation to Cryptocurrencies. This communication serves only educational and informational scopes and does not represent investment research. The information provided here is not to be construed as a personal investment advice or recommendation to engage in any trading strategy involving Cryptocurrencies. Cryptocurrency platforms and the services offered in relation to Cryptocurrencies are not currently regulated on an EU level. Cryptocurrencies are subject to a number of significant risks including lack of regulation risk, market liquidity risk, volatility risk, counterparty risk, risk of partial or total loss of the invested amount, risk of insufficient information disclosure, project risk, technical and operational risk and fraud risk. Since not all products or transactions are suitable or appropriate for all investors, you shall not enter into any transaction unless you have consulted your independent advisors to make sure that, irrespective of the information herein, the planned investment fits into your needs and preferences and the involved risks are fully understood by you.

The author of this communication takes no responsibility for the content of any third-party site. Links to third-party sites are provided solely for your convenience and information; accessing such sites is at your own risk. Any statements or opinions contained in this communication are made as at the date and time of dissemination only and there is no intention to update this communication in the future.