Investment Committee - February 2026

- Feb 5

- 3 min read

Updated: 1 day ago

Resilience, Nuance, and the Systematic Anchor

The Dominant Theme: The "Warsh" Paradox

The Investment Committee convened this month to interpret a market sending contradictory signals. The dominant force was the speculation surrounding Kevin Warsh as the potential next Federal Reserve Chairman. The narrative is complex: while Warsh is historically viewed as a "hawk" with a preference for a tight balance sheet, market participants are grappling with a dual reality.

On one hand, his nomination signaled a stronger US Dollar and tighter financial conditions, triggering an immediate repricing of risk. On the other, sophisticated observers note that a Warsh-led Fed might paradoxically necessitate steeper rate cuts to offset a contracting balance sheet. This internal conflict—hawkish on liquidity, potentially dovish on rates—created a vacuum of uncertainty that defined the month’s early volatility.

Market Resilience: Absorbing the Shock

We caution against viewing the market as purely "Teflon." The initial reaction to the Warsh news was a genuine risk-off event, with S&P and DAX futures tumbling significantly as global markets digested the strong Dollar signal.

However, the defining characteristic of this period was the speed of the recovery. Equity markets absorbed the initial blow and reversed course within sessions. The Committee views this not as complacency, but as a structural bid for equities that is looking past the immediate personnel "noise" and focusing on the broader economic mandate.

Metals: Macro Catalyst, Mechanical Amplification

The "debasement trade" (Gold and Silver) faced a perfect storm. The Warsh news provided the fundamental catalyst—a spiking Dollar and rising real rate expectations—which naturally pressured non-yielding assets.

However, the severity of the drop (with Silver down markedly in a single session) was a function of market mechanics amplifying the macro signal. A sudden increase in exchange margins forced a liquidation cascade, flushing out leveraged positioning. We view this as a healthy, albeit painful, clearing of the decks. While the long-term thesis remains, the volatility necessitates a tactical reduction in gross exposure to preserve capital.

The "Perfect" Earnings Problem & A Slight Tilt to Value

A critical signal from Q4 earnings is that "perfection" is no longer sufficient. We witnessed technology bellwethers deliver record AI and Cloud numbers, only to see their stock prices retreat. The "easy beta" in mega-cap tech appears exhausted for the short term, as the bar for upside surprises has become mathematically prohibitive.

In response, the Committee is making a nuanced adjustment. We are not abandoning growth, but we are acknowledging the valuation spread. We are introducing a slight tilt towards Dividend Leaders—high-quality franchises with robust cash flows. This is not a defensive rotation, but rather an incremental diversification of our equity bucket to include assets that historically perform well when the cost of capital remains elevated.

Refresher: The Systematic Imperative

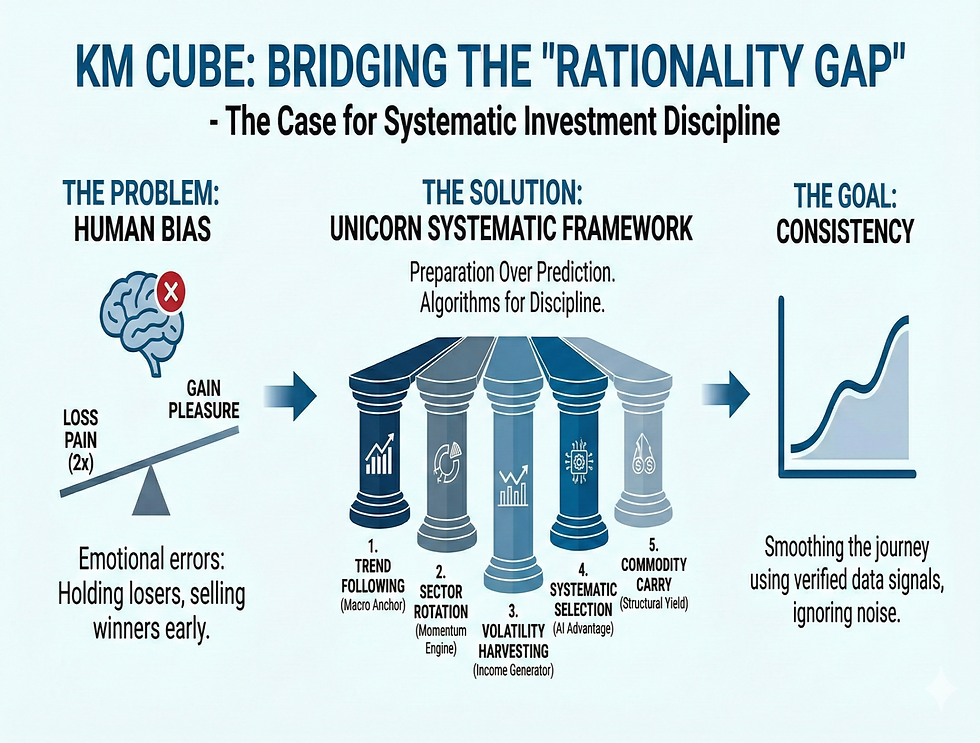

Beyond the immediate market mechanics, the Committee dedicated a session to a fundamental pillar of our investment philosophy: Systematic Discipline.

We presented a refresher on our proprietary "Unicorn" framework, emphasizing that this is not a tactical reaction to current market conditions, but a permanent solution to the investor’s oldest enemy: behavioral bias. Whether the market is in a "melt-up" or a correction, human emotion (Prospect Theory) consistently leads to suboptimal risk management. The Committee reaffirmed that a rules-based, multi-strategy approach—strictly separating signal from noise—remains the most effective tool for long-term risk control.

The Verdict: Pro-Risk Neutral

The Committee concludes with a "Pro-Risk Neutral" mandate. We are not retreating to cash, but we are refining our exposure.

Tactical: Reduce volatility exposure in commodities following the margin-induced shakeout.

Structural: Incrementally weight Value/Dividend quality to broaden exposure beyond pure tech beta.

Foundational: Re-commit to systematic allocations to ensure portfolio decisions remain driven by data, not sentiment.

Authors: Kostas Metaxas, Yiannis Sapountzis and Kostas Asimakopoulos