Positioning for inflation ahead

- Oct 11, 2021

- 2 min read

Updated: Oct 24, 2024

KM Cube’s Investment Committee discusses strategies to position for an inflationary environment, using niche tools available in our product line. These summarized notes highlight our perspective for what is considered one of the main portfolio risks going forward.

Inflation is important for portfolios and for managing assets, whether it is from the return side of the equation (where you may generate capital appreciation) or the risk side of the equation. Some of our research found that when it came to the risk side of the equation (where you will need hedging techniques to mitigate the downside) then bond volatility was very much usually driven by inflation. Hence inflation may well be a cause of downside price movement for government bonds. To moderate that risk we like treasury-inflation-protected-securities (TIPS). The notional value of a TIPS bond increases while inflation rises, and it decreases when inflation falls. The good thing is that when TIPS mature, you get paid the adjusted principal or the original principal, whichever is greater! We also highlight other asset classes like commodities, which we discuss below.

A main issue is that we haven’t seen prolonged inflation in developed markets for a long time. We consider inflation a tail risk event because it has the potential to negatively impact both equities and bonds at the same time. That being said, we consider extreme upside inflation a very rare event, and this also brings challenges with regards to how much one would want to allocate to inflation strategies.

Today, the Committee still thinks of inflation exposure as an insurance policy. Our approach is to have a lower risk budget to inflation trades compared to momentum or value.

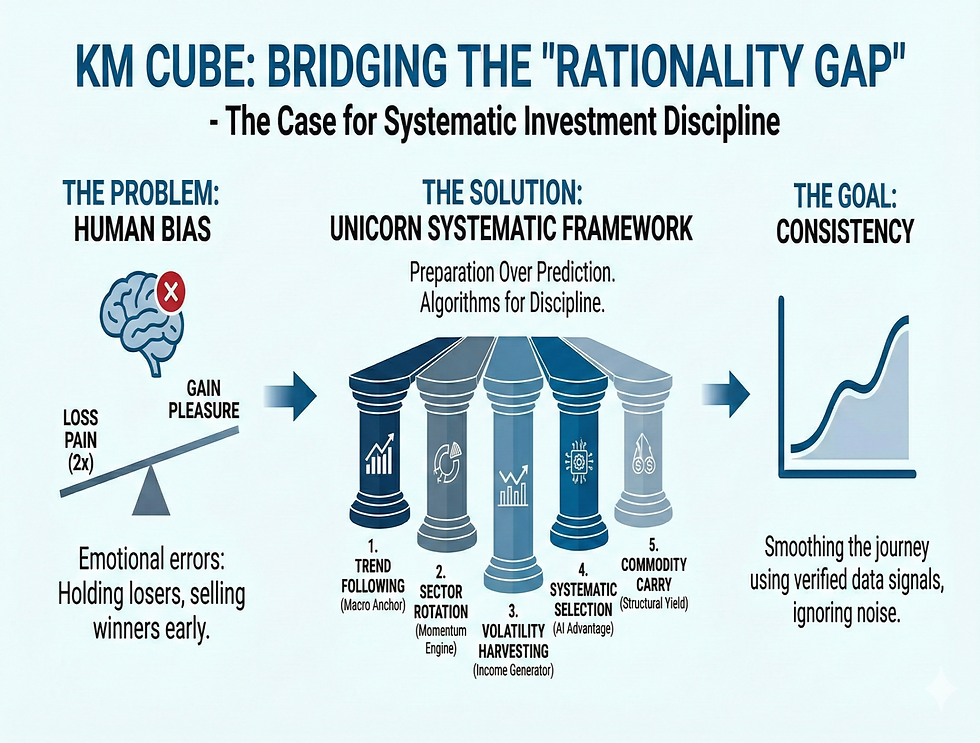

Our job is to provide clients with tools and solutions that provide an edge and differentiate us from the competition. We aim to do that through relatively new products that weren’t available during the prior inflation cycle. Various asset classes are sensitive to inflation; commodities or specific fixed income instruments in a rising rate environment come to mind. Such analysis actually is coded up and systematized via our ‘Unicorn’ systematic strategy, which ultimately can become an overall investable solution for our clients. A more structural choice can be interest rate steepeners.

Commodities work well in an inflationary age, especially when compared relative to other asset classes. But because commodities have run a long way after the coronavirus crisis, we fear they may be sensitive to a large drawdown if inflation expectations actually ease. Thus, we are concerned about adding commodity beta at current levels. We suggest clients focus mainly on gold and perhaps through a series of derivatives that add to gold exposure at lower levels, say at $1500-$1600 area.

Value stocks have shown some sensitivity to interest rates lately. So, in an environment of lower growth and higher rates, investors may look to equities like value to replace their stock exposure. Our strategists have come up with a Selection of Value Stocks – a monthly updated list of stocks filtered for qualitative metrics and value criteria which we believe suit the environment to come.