Why investors lose money

Do you know that private investors are more likely to suffer big losses than other market participants?

Read More →The end of the liquidity driven rally. What lies ahead?

The end of the liquidity driven rally, what lies ahead? The economic crisis which sparked from the global pandemic created the perfect storm for ‘money printing’ by the Fed. The liquidity response to the crisis was very strong, highlighted by the direct purchases of corporate bonds and stock market ETFs for the first time in Fed’s history. However, the vast majority of the liquidity came through monetization of debt

Read More →Your 60/40 portfolio and the danger zone

There is a lot of talk lately regarding the 60/40 portfolio due to its simplicity and performance (2020 included). It surely gives good argumentation to the passive management camp and makes investing look simple.

Unfortunately investing is not simple, the 60/40 portfolio is not magic and in the current environment it may prove to be a significant source of risk for the market participants.

Gold miners vs Gold: A word of caution

Investors often buy gold miner stocks as an indirect play to gain exposure to gold. While there is nothing wrong with such investment one should be cautious on the differences, as the devil lies in the details…

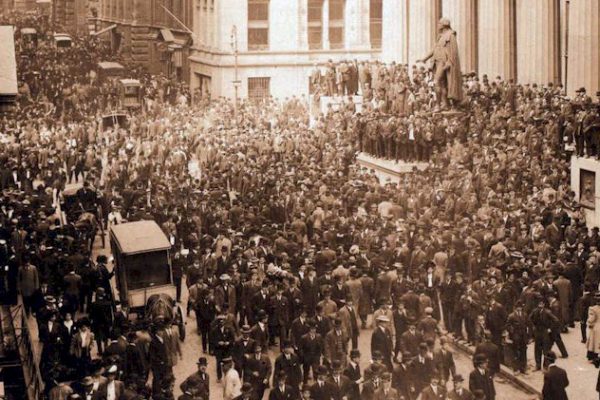

Read More →1907 Bankers’ Panic and the birth of the FED

In this series of posts we intend to highlight significant events in the history of financial markets. Learning from the past helps us understand the evolution of things and can also give us insights into the future. We believe this is particularly true for the financial markets.

Read More →